Manage Coverage More Successfully Through CFD Trading

When investors discover methods to increase their portfolios, the focus usually changes towards methods that enable for freedom, convenience, and growth. One particular technique is cfd trading. CFDs, or Contracts for Huge difference, provide an energetic way to diversify a portfolio while interesting with a selection of markets. This trading mechanism keeps growing in popularity among contemporary investors who price versatility and the potential for significant returns.

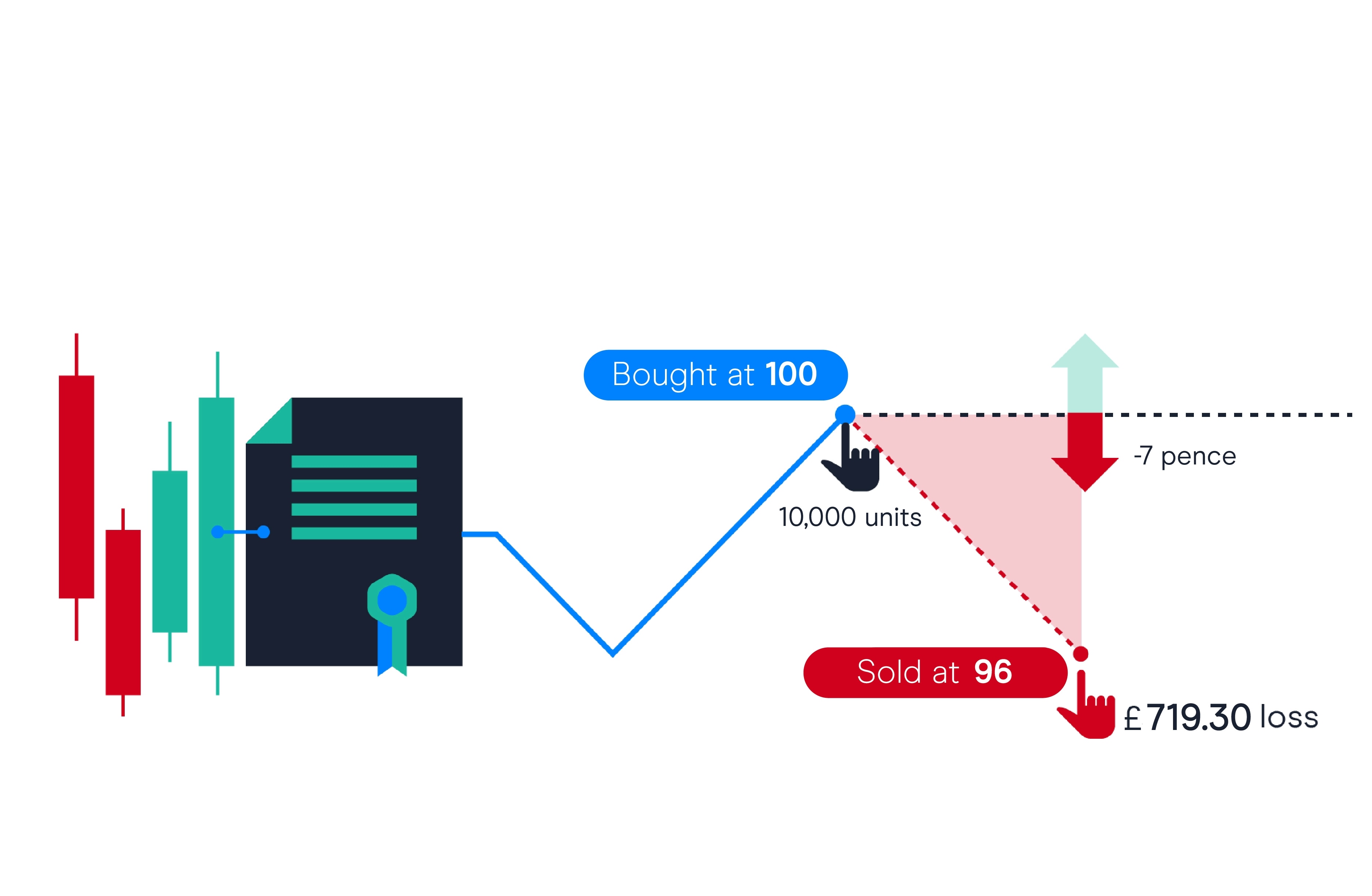

If you are fascinated by progressive trading practices or are seeking collection diversification, that blog post may explain the advantages of CFD trading and why it's taking the eye of investors globally. Understanding CFD Trading CFD trading is a financial derivative which allows investors to suppose on the cost movements of resources without buying the main advantage itself. These resources can vary from shares and commodities to currencies and indices. The sweetness of CFDs is based on their simplicity. Whenever you deal CFDs, you acknowledge to switch the big difference in the buying price of a resource from the opening of the agreement to their closure. This implies you're maybe not getting physical gives or commodities, but alternatively profiting from the speculation of cost changes. Why Select CFDs for Diversification? Diversification is the foundation of a well-balanced investment portfolio. By scattering investments across numerous asset classes, chance is mitigated while the performance of just one asset doesn't overly impact the entire portfolio. CFD trading aligns perfectly with the diversification ethos, offering a wide selection of opportunities across numerous markets. Advantages of CFD Trading Usage of Numerous Markets CFD trading provides access to a wide array of areas, such as for instance forex, equities, commodities, and cryptocurrencies. Instead of inserting exclusively to shares or ties, investors may explore diverse paths and tap in to international opportunities. The flexibility to industry assets from different industries simplifies the diversification process while permitting larger experience of various industries and financial climates. Leveraging Possibilities for Larger Returns Power is one of the most unique aspects of CFD trading. With control, an investor may start bigger jobs than their capital might traditionally allow. For example, trading with influence may allow a trader to control an advantage value $10,000 while only investing a fraction, say $1,000. That makes CFDs desirable for anyone seeking high results, presented additionally they accept the accompanying risks. Leverage increases equally gains and failures, therefore it's imperative to learn how to use it responsibly. However, when used properly, it provides an exceptional solution to improve returns while conserving allotted capital.

Variable Trading Hours Areas perform on different time zones, but CFD trading accommodates this with usage of trading nearly 24 hours a day. This function is very very theraputic for those seeking to industry with freedom and outside firm working hours. The prolonged availability provides more options to react to advertise movements in real-time, enhancing the range of trades and outcomes. Power to Trade Long or Short CFDs provide the flexibility to profit from both climbing and slipping markets. Standard equity investments are often reliant on advantage prices raising around time. However, with CFD trading, traders may get extended (buy) when they anticipate advantage prices can increase or move small (sell) once they assume rates to fall.